Kudbiyev speaks about tax audits, individual benefits, VAT and cashback

Kun.uz interviewed Chairman of the State Tax Committee Sherzod Kudbiyev about the news, tax audits, individual benefits and preferences, VAT, cashback and other issues mentioned in the President’s dialogue with entrepreneurs.

- It is known that tax preferences and taxes create an uneven business environment. But many companies in Uzbekistan are given such privileges. Recently, statistics about this have been punlished. It also turned out that they received a big benefit. Are there any plans to withdraw these benefits? If so, when will it happen?

- A very valid question. The State Tax Committee is the body that issued those statistics. We will post monthly and quarterly announcements (each benefit is shaped differently).

Secondly, in general, total benefits are viewed with displeasure by the state tax authorities. The reason is that our income will decrease. We look very negatively at individual benefits.

Of course, some places have to be reduced a lot. It is decreasing year by year. The number of benefits, the number and amount of users are decreasing. We are proposing to shorten it from January 1, 2023, some – from 2024.

- In general, what about the total cancellation, are there any plans for this?

- This is also being worked on. However, there is instability in the adopted legal norms. As you said, some of our laws state that the tax regime should not change for several years, depending on the investment of foreign investors.

But the Tax Committee’s position is that we should phase out all the benefits. They should be motivated in another way.

- Brand companies from around the world bring their products to Uzbekistan, but they do not have production plants in Uzbekistan. They have to import their products. That is, additional taxes and other expenses are added to the price. What are the risks of their entry into Uzbekistan?

- In my opinion, these are not risks. Only the positive side can be seen from the point of view of economic activity in Uzbekistan, political stability, attention to entrepreneurs in the country and investment. But the entry of foreign brands into Uzbekistan should be considered not only from this point of view, but also from the point of view of their market capacity. Whether it would be cheaper for them to manufacture here in terms of entry cost to the market or import. The laws of the market are probably at work here, I think.

Of course, investment attractiveness also plays an important role. That’s why I don’t see any risk from this side. From next year, the 12% VAT will be one of the lowest tax rates among neighboring countries and among the countries of the Commonwealth of Independent States.

- Economists and activists say that one of the main reasons why entrepreneurs avoid paying taxes in Uzbekistan is the size of the tax burden. It is said that they try to hide income for this reason. How do you feel about these ideas?

- True, we also conducted a survey on our Telegram channel while developing these proposals. About 70,000 respondents took part in it. That is, a social survey of 70,000 people is a big survey. There was a question of why you do not give a receipt.

Almost 25% of the participants answered that it was because of the increase in the tax burden. So, in the development of these proposals, this tax burden, almost a fifth of VAT, is reduced. The tax burden is decreasing by 20%.

- Representatives of small business raise objections regarding the variety and severity of fines related to tax audits. What changes are expected in this regard?

- Let me tell you, there are three types of audit. There are inspections called mobile tax inspection, camera tax inspection and tax audit. There are about 550,000 legal entities in Uzbekistan, and 350 inspections have been completed in January-August, that is, until today. Is this too much or too little for 550,000 organizations?

Second, which inspections have increased compared to last year? Cameral and mobile tax audits remain. Chamber tax audits decreased by almost 2.5 times from last year. At the expense of what? Last year, there was a lot of controversy and the tax authorities were given this authority: after each report is submitted, the state tax authorities conduct a pre-tax audit study. We are sending him a letter if the tax return has been filed. Then there is a difference in these places. We say: “Check it, maybe there is an error somewhere due to some reason”. The number of camera tax audits has decreased by 2-2.5 times due to saying that “we will not check it, fix it yourself”.

Which tax audits have increased? Mobile tax audits, that is, state tax service authorities come and impose fines on businesses that have not issued a receipt, have increased. Only one type has increased. What are these checks all about? You must have encountered in your life, has issuing a receipt on the street increased or not?

- It has increased.

- I will tell you a number. Compared to last year, the turnover through online cash registers increased by 1.6 times. This is not found in any economic legislation – 60% increase. Usually, the economy can grow by 5%, due to inflation – by 15%. But 60% growth means that the shadow economy is coming out even a little bit.

You say that issuing receipts has also increased. Of course, these all have happened thanks to inspections, the Ministry of Finance, the government and our deputies. They supported this system. We distributed cashback worth 330 billion to people, it’s not about payment. People are psychologically interested in it and are collecting cashback.

Secondly, of course, there was no guarantee of the inevitability of punishment in those 30 years. This thing is coming up now. Not many people like it. Many people have a reason not to issue a receipt because the tax burden is increasing or they think that if they issue a receipt, they have to transfer the money to the bank, and they won’t be able to get it from the bank the next day. But according to the current legislation, the equal conditions have been created for everyone in the market.

Imagine that we both sell coffee. You issue a receipt, but I issue nothing. I will have a competitive advantage though. Everyone comes and buys coffee from me. Because if I do not present customer’s receipt, I will have a competitive advantage over you from a tax point of view, from a revenue point of view, from an operational cost point of view. If you present everyone a receipt, you have to show everything, both your operating cost and your tax burden will be higher.

Therefore, issuing a receipt is very important and necessary, not from the point of view of ensuring the tax burden, but from the point of view of creating the same conditions in the market. Since your audiences are wide, I would like to request that it is our very important task to create the same conditions for all entrepreneurs.

One can watch the full interview in the video above.

Related News

18:34 / 26.05.2025

Uzbekistan launches new tax inspectorate to enforce product labeling rules

16:55 / 15.05.2025

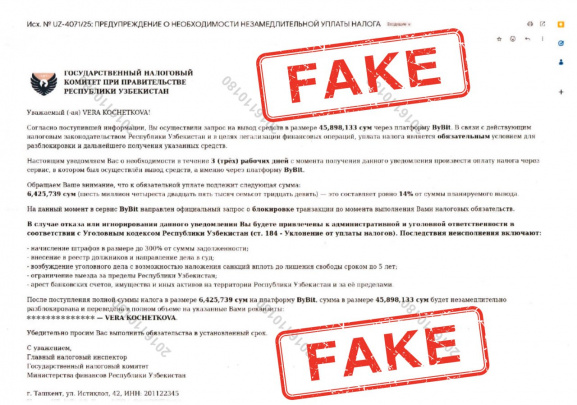

Tax Committee warns of fraudulent emails about tax debt

13:18 / 13.05.2025

Gov’t plans to tax bloggers earning from online ads

20:57 / 05.05.2025