Controlling card-to-card transfers unconstitutional

On May 1, two conflicting legal norms came into force in Uzbekistan. The new Constitution, which includes an expanded norm on bank secrecy, came into effect. Starting from this date, it is planned to introduce this illegal practice – tax collectors will collect information on card-to-card transfers of all citizens.

Photo: Kun.uz

As of May 1, a number of changes came into force in the legislation of Uzbekistan. The most important of them is the newly revised Constitution.

According to the law adopted in the referendum on the constitution, the Cabinet of Ministers must develop the program of adaptation of the legislation to the new constitution and submit it to the parliament within 2 months.

This change program may also include the cancellation of a new procedure for card-to-card transfers. Because the new Constitution requires it.

The fact is that according to the presidential decree signed on February 10, 2023, organizations providing payment services (banks and payment systems such as Payme, Click) when making money transfers between individuals, for the services provided to them (even if the commission is “0” soums) electronically issues invoices and submits them to tax authorities.

This means that the tax authorities are aware of transfers between tens of millions of cards issued in Uzbekistan.

This norm was added to the decree without legal examination. Paying organizations may not have passed the linguistic examination since it is written that electron invoices “provide and officialize” because the sequence of words in the sentence should be in the form “officialize and provide”.

Earlier, Kun.uz wrote that this procedure contradicts at least two laws – “Bank secrets” and “Payments and payment systems” laws, and noted that this procedure contradicts the new version of the Constitution.

On April 13, the leadership of the ministry and the committee met with representatives of banks and payment organizations and discussed how to organize transfer of information about transfers to tax authorities.

Representatives of the Tax Committee rejected Kun.uz invitation to talk with economists on the same topic.

According to Shukhrat Kurbanov, an economist interviewed by Kun.uz, the invoice shows only the information of the sender, not the receiver. This casts a shadow over the assumption that tax officials are targeting tax evaders through P2P trading. Kurbanov also remembers that Kazakhstan tried to introduce a similar procedure earlier, but after criticism and objections, the neighboring country withdrew from this idea.

“Kazakhstan’s deputy finance minister said that a 10% increase in non-cash payments would lead to a 1% increase in real GDP,” he said.

Another economist, Otabek Bakirov, who participated in the interview, drew attention to the fact that legislative bodies and the Central Bank are silent on this issue. On May 2, on his Telegram channel, in connection with the adoption of the new constitution, he urged to immediately stop providing information on P2P transfers to the tax authorities, and the tax authorities to refuse to receive this information.

Tax consultant Murod Muhammadjonov told us that the purpose of P2P transfer control may be to make money from the invoice. He expressed concern that the tax authorities will block the transfer of funds to some individuals.

On May 2, Kun.uz contacted the press services of a number of banks and payment organizations with the question of whether the invoicing and transfer to the tax authorities has started. Further information will be provided when responses are received.

Related News

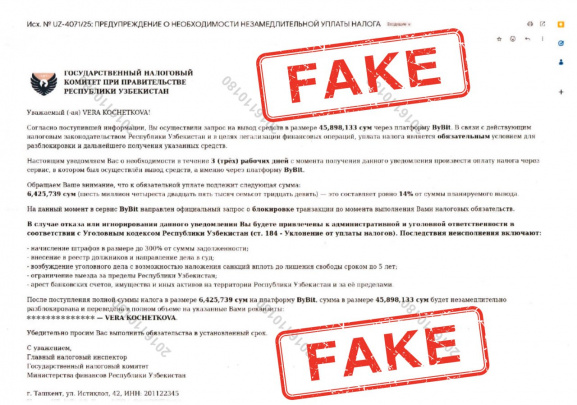

18:34 / 26.05.2025

Uzbekistan launches new tax inspectorate to enforce product labeling rules

16:55 / 15.05.2025

Tax Committee warns of fraudulent emails about tax debt

13:18 / 13.05.2025

Gov’t plans to tax bloggers earning from online ads

20:57 / 05.05.2025