Tax for cement producers reduced by 4 times; state budget losing again billions in revenue

It was planned to reduce the tax rate on limestone intended for cement production by 2 times, but in practice it was reduced by almost 4 times. Most of the cement production capacity in Uzbekistan is controlled by offshore companies and Chinese investors. Even in 2022, the concessions granted on the natural resources did not benefit, the budget lost 2 trillion soums.

Photo: RIA Novosti

Starting from 2024, the government and parliament of Uzbekistan reduced the tax rate on limestone intended for cement production by almost 4 times: from 22,500 soums to 6,000 soums per ton.

However, in the budget statement announced by the Ministry of Economy and Finance at the end of 2023, the plan was to reduce this rate by 2 times – from 22,500 soums to 11,250 soums.

According to the authorities, the reduction of the tax rate is related to the goals of “preventing a sharp increase in the price of cement products and price increases”, “increasing the competitiveness of domestic producers in front of foreign cement suppliers”.

Figures: Cement production increased by 39% in 4 years

The Ministry of Economy and Finance informed Gazeta.uz that cement production capacity in the country has increased by 1.8 times in recent years (from 15.1 million tons in 2019 to 26.7 million tons in 2023).

During this period, the production volume increased by 1.4 times – from 10.9 million tons to 15.2 million tons. At this time, the demand for cement increased 1.2 times – from 13.8 million tons to 16.5 million tons per year.

According to the MEF, in 2024, the capacity of factories will increase by 30% or 7.9 million tons to 34.6 million tons, and the production volume will increase by 10% or 1.6 million tons to 16.7 million tons. Import is expected to decrease to 1 million tons (decrease – 57% or 800 thousand tons).

The Ministry predicted that local enterprises will be able to cover 98% of the demand in the domestic market.

“Increase in tax rate has led to increase in cement prices”

Uzsanoatqurilismateriallari association made an additional comment on the situation. It is noted that, until 2019, the tax rate for limestone was 5%. Since 2019, this amount has been increased and set at 22,500 soums (or 75% of the cost of limestone) per ton of limestone produced.

“This has led to an increase in cement prices. Currently, the average price of one ton of limestone is 30,000 soums. Lowering the tax rate on limestone is aimed at increasing the competitiveness of domestic producers.

Despite the reduction of rates, the tax for the use of subsoil is 20 percent of the cost of limestone in Uzbekistan, 4.7% in neighboring countries: Kazakhstan, 3% in Kyrgyzstan, and 7% in Tajikistan,” the official report reads.

Cement became cheaper throughout 2023

Economist Otabek Bakirov said that the argument of Uzsanoatqurilishmateriallari association that the price of cement has increased due to tax increase is not true.

The Uzsanoatqurilishmateriallari association’s argument, which claims that high taxes have led to an increase in the price of cement, is so weak and fragile that I have doubts about the awareness of the association, which considers itself a ministry, about cement prices.

So, the average exchange prices for cement are:

• December 9, 2022: 601 thousand soums per ton;

• December 11, 2023: 571.4 thousand soums per ton;

• January 9, 2023: 605.5 thousand soums per ton;

• January 9, 2024: 550.4 thousand soums per ton.

Similarly, you can compare the price dynamics of the corresponding periods of 2023 and the corresponding periods of 2022. Prices have had a clear downward trend throughout 2023 (and the last 6 years). That is, it is a lie that cement has become more expensive because of high taxes on cement producers,” Otabek Bakirov wrote.

According to the economist, the defense argument that if cement becomes cheaper, housing and construction will become cheaper, does not describe the real situation.

“In January 2023, cement prices are cheaper than in January 2018. But house prices have doubled in dollars in Tashkent and in the regions. Where is the connection? I won’t talk about bridges and roads on state orders,” Bakirov said.

Who owns the big cement plants?

According to the information of the Uzsanoatqurilishmateriallari association, there are a total of 37 enterprises specializing in the production of cement in Uzbekistan, and their annual capacity is 32.7 million tons. There are 14 enterprises with a capacity of 1 million or more.

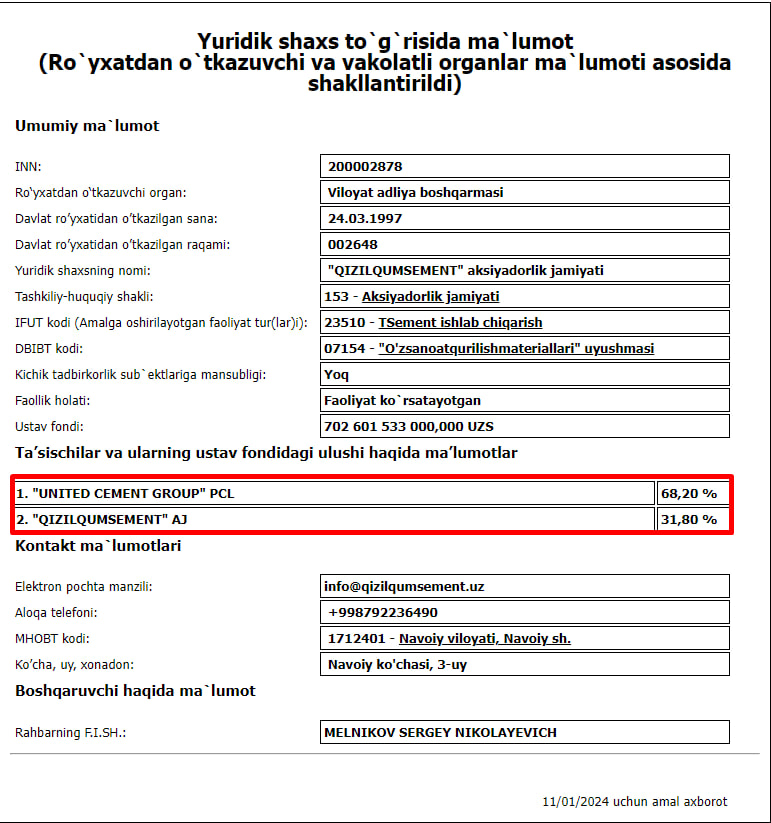

Kizilkumsement JSC

It has the capacity to produce 5.7 million tons of cement per year. 68.2% of the plant belongs to the offshore company United Cement Group registered in Cyprus, and 31.8% to Kizilkumsement itself.

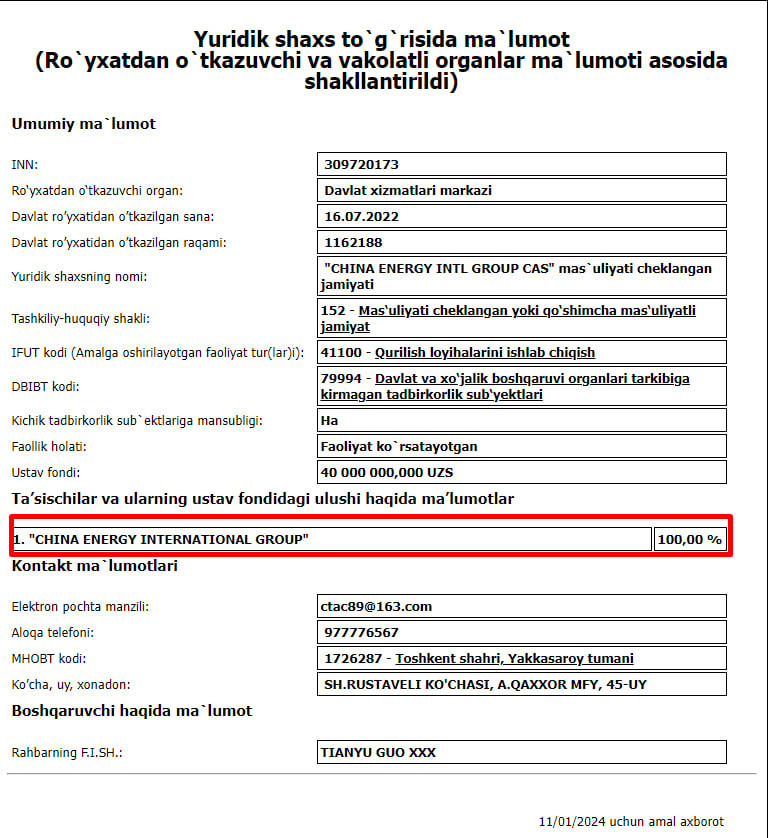

China Energy International Group Samarkand Cement LLC

Annual capacity – 3 million tons. 100 percent share belongs to China Energy International Group.

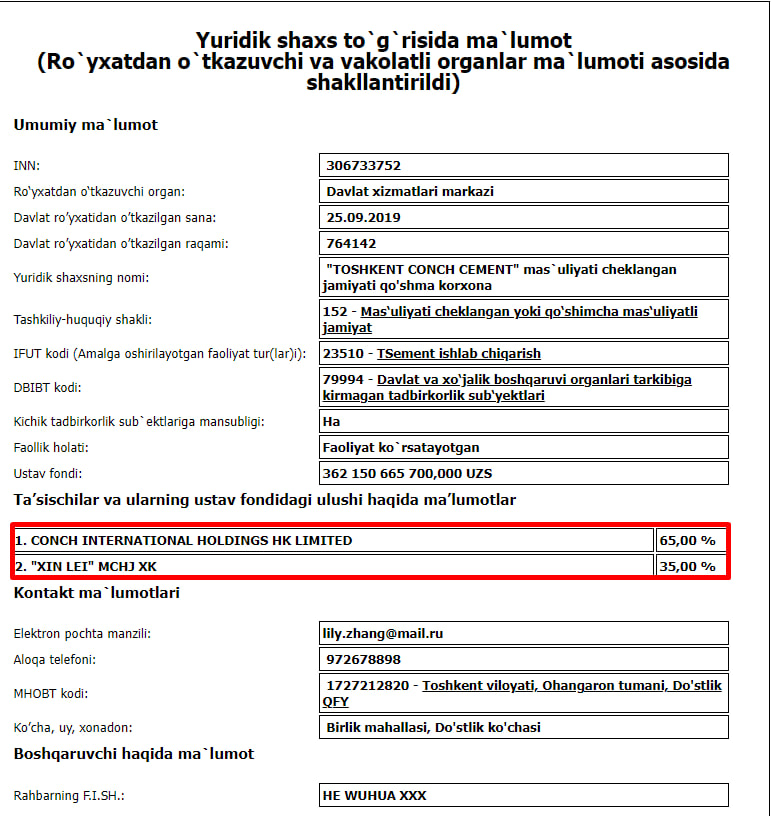

Tashkent Konch Cement LLC

Annual capacity – 2.5 million tons. Conch International Holdings owns 65%, and Xin Lei LLC owns 35%.

Also, the following are major cement producing enterprises:

• Akhangaransement JSC, annual capacity – 2.4 million tons. The plant belongs to Akkermann Cement CA, which is related to Alisher Usmanov;

• Fergana Yasin Construction Goods LLC, annual capacity – 2 million tons. 90% of the plant belongs to Shanxi Xiangsheng, 10% to Great Amirkhan Oil;

• Qoraqalpoqsement LLC, annual capacity – 1.8 million tons;

• Huaxin cement jizzakh LLC, annual capacity – 1.66 million tons. The sole founder is Huaxin Central Asia Investment;

• Bekobodsement, annual capacity – 1.6 million tons. It belongs to the above-mentioned United Cement Group. This company also owns Kuvasoysement (capacity – 1.08 million tons).

Tax reduction is a big loss to the budget

As a result of the 4-fold reduction of taxes for cement plants, the receipts to the state budget will decrease by several 100 billion soums. This kind of practice to increase production capacity has happened before, but it did not work.

In particular, in 2022, taxes on natural wealth were significantly reduced in Uzbekistan. For private companies, the tax rate for natural gas was reduced by 3 times, and for oil and gas condensate by 2 times. It was said that the purpose of this is to encourage private companies to make investments.

In practice, in 2022, the users of the underground will pay about 2 trillion soums or 12% less taxes than a year ago, gas production will decrease by 4%, and gas condensate production will decrease by 3%.

This trend continued in 2023. In particular, the volume of gas production in 11 months was 42.75 billion cubic meters and decreased by 9.6 percent or 4.56 billion cubic meters compared to the same period of 2022. Also, oil production decreased by 1.7%, gas condensate production decreased by 7%.

Related News

18:34 / 26.05.2025

Uzbekistan launches new tax inspectorate to enforce product labeling rules

16:55 / 15.05.2025

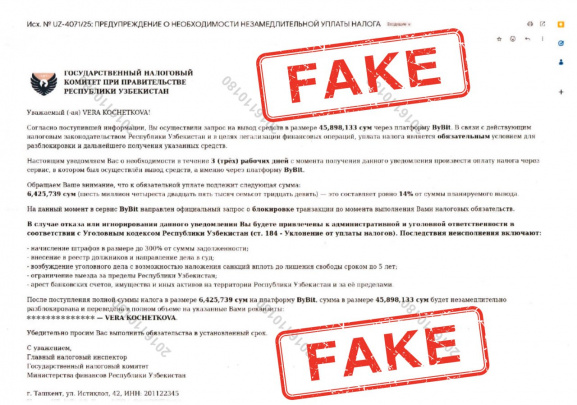

Tax Committee warns of fraudulent emails about tax debt

13:18 / 13.05.2025

Gov’t plans to tax bloggers earning from online ads

20:57 / 05.05.2025