Fines for tax-related offenses significantly reduced in Uzbekistan

Corresponding changes and additions have been made to the Tax Code of the Republic of Uzbekistan.

Photo: Depositphotos

The law of May 29 amended the Tax Code, according to which the amounts of financial sanctions for committing fiscal offenses are changed.

Now, violation of the requirements or procedure established by law for displaying fiscal marks or equipping with automated measuring instruments or ensuring integration with information systems of tax authorities, as well as the rules for mandatory digital labeling of goods (products) with identification means, entails a fine of 2% of the net revenue received in the last reporting quarter in which the sale took place.

Previously, this violation was subject to a fine in the amount of net revenue received for the entire last reporting quarter.

At the same time, sanctions have been established for violations that are committed repeatedly within a year after the imposition of the fine. Violators face a fine of 20% of the net revenue received in the last reporting quarter in which the sale took place.

Prior to that, liability for such a violation was not envisaged.

The law comes into force from the moment of its official publication.

Related News

18:34 / 26.05.2025

Uzbekistan launches new tax inspectorate to enforce product labeling rules

16:55 / 15.05.2025

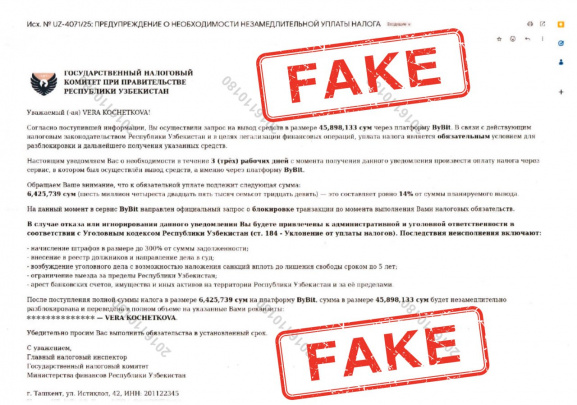

Tax Committee warns of fraudulent emails about tax debt

13:18 / 13.05.2025

Gov’t plans to tax bloggers earning from online ads

20:57 / 05.05.2025