Tax revenues increased by 11% in H1 2024

In the 6 months of 2024, tax revenues to the state budget increased by 11.4% compared to last year. In the second quarter, property tax revenues increased by almost 1.5 times. Earlier, it was reported that in the first half of the year, the state budget deficit increased by 27% and reached 34 trillion soums.

During the 2nd quarter of 2024, tax revenues to the state budget amounted to approximately 45.5 trillion soums. This is 18.4% more than the same period last year, the Tax Committee reported.

In the 2nd quarter, there was an increase in all types of taxes. The highest increase is property tax – 45%. Excise tax (36.6%) and VAT (26.5%) took the next places.

Revenues (increase compared to the corresponding period of the previous year) in the section of tax types are as follows:

• profit tax – 9.5 trillion soums (10.6%);

• VAT – 9.4 trillion soums (26.5%);

• income tax from individuals – 9.2 trillion soums (18.7%);

• excise tax – 4.6 trillion soums (36.6%);

• subsoil use tax – 4.1 trillion soums (16.2%);

• land tax – 2.2 trillion soums (32.1%);

• property tax – 1.8 trillion soums (45%);

• turnover tax – 756.1 billion soums (1.7%);

• tax for the use of water resources – 186.1 billion soums (0.4%).

In the 1st quarter, tax revenues to the budget amounted to 40.3 trillion soums. Based on these figures, tax revenues in the 6 months of 2024 amounted to 85.8 trillion soums. This is 11.4% more than the indicator in the first half of last year.

Earlier, it was reported that the state budget deficit in the first half of 2024 exceeded 34 trillion soums. In 6 months, the revenues of the state budget amounted to 115.8 trillion soums, and the expenses amounted to 149.8 trillion soums, and the deficit reached 34 trillion soums. This is almost 27% more than the previous year.

Related News

18:34 / 26.05.2025

Uzbekistan launches new tax inspectorate to enforce product labeling rules

16:55 / 15.05.2025

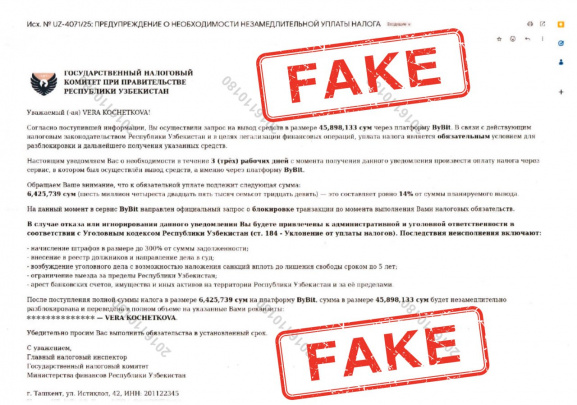

Tax Committee warns of fraudulent emails about tax debt

13:18 / 13.05.2025

Gov’t plans to tax bloggers earning from online ads

20:57 / 05.05.2025