Uzbekistan to impose new excise tax on sugary drinks, increases on property taxes

The Ministry of Economy and Finance has outlined changes to the country's tax policy, set to take effect on January 1, 2025. Key adjustments include a 10% increase in property and land tax rates, as well as new excise taxes on sugary beverages. These revisions aim to improve revenue generation while also promoting responsible resource use and environmental sustainability.

Photo: Fotolia

Starting in January, the property and land tax rates for both individuals and businesses will increase by 10%. Additionally, an excise tax of 500 Uzbek UZS per liter will be applied to all sugary beverages, a measure that will cover soft drinks, fruit juices, and non-carbonated sugary teas. This excise tax is scheduled for full implementation by April 1, 2025.

Most core tax rates, however, will remain unchanged, including corporate profit tax (15%), value-added tax (12%), personal income tax (12%), and social tax (12% for most entities and 25% for budgetary organizations). The rate for property tax on legal entities remains at 1.5%, while turnover tax continues at 4%. Water usage fees for agriculture and fishery sectors are also unchanged at 100 UZS per cubic meter.

The ministry also plans to raise excise taxes on fuel and oil products, including gasoline, diesel, and motor oils. From April 1, 2025, the excise tax rates on these products will increase by 10%, affecting end consumers as well.

In line with sustainable resource management, water usage taxes will also see an adjustment. From January 1, 2025, an average 10% tax increase will apply to water used by industries such as electric power stations, communal service providers, and beverage manufacturers. Furthermore, a new tax rate of 15,000 UZS per cubic meter will be introduced for water used in car washes.

Additional policy adjustments will address mining resources, with new tax rates on extracted materials like marble, granite, and decorative stones. The ministry’s proposal also includes a 10% indexation on tax rates for certain construction materials and other non-metallic resources.

Finally, a 10% increase in the base land tax rate will be implemented for both corporate and individual landholders starting next year. Regional councils, including Karakalpakstan’s Jokargy Kenes and provincial councils, will retain the authority to apply economic development-based adjustment coefficients to property taxes on non-residential assets.

Related News

18:34 / 26.05.2025

Uzbekistan launches new tax inspectorate to enforce product labeling rules

16:55 / 15.05.2025

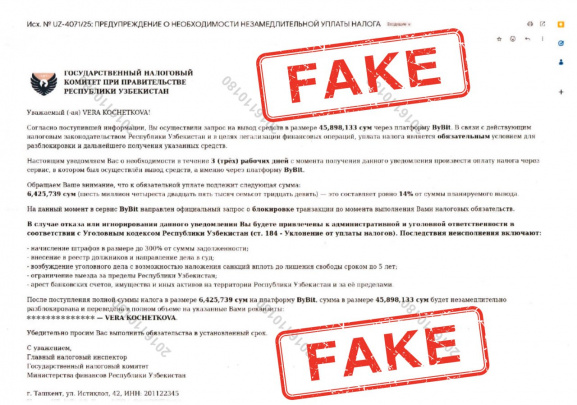

Tax Committee warns of fraudulent emails about tax debt

13:18 / 13.05.2025

Gov’t plans to tax bloggers earning from online ads

11:43 / 08.05.2025