Uzbekistan to abolish excise tax on mobile communications

Uzbekistan is set to eliminate the excise tax on mobile communications, reversing a previous government decision to retain it. In February 2023, the Tax Committee announced that the excise tax on mobile services would be 10%. President Shavkat Mirziyoyev had earlier proposed that this tax be fully abolished by the end of 2023, following a reduction from higher rates to 10% in 2022.

In addition to changes regarding mobile communications, the government has outlined plans for various adjustments to excise taxes starting next year. Beginning in April, the excise tax on sugar-sweetened carbonated beverages, currently set at 500 UZS per liter, will extend to all sweetened drinks, including juices and iced teas.

The excise tax on diet drinks containing sugar substitutes will be lowered to 300 UZS per liter, while the rate on energy drinks will remain unchanged at 2,000 UZS per liter. Furthermore, imported natural gas will once again incur an excise tax, but the rate will decrease from 20% to 12%. Excise taxes on petroleum products, including gasoline, diesel, liquefied, and compressed gas sold to end consumers, will see a 10% increase starting April 1.

Changes will also be made to the excise tax on filter cigarettes: the ad valorem rate of 10% will be abolished, and the rates for both imported and domestic cigarettes will be standardized at 340,000 UZS for 1,000 units, up from the current rates of 300,000 UZS for imports and 330,000 UZS for local products.

The new tax policy aims to gradually equalize excise taxes on domestic and imported alcoholic beverages, with rates for local producers increasing and those for importers decreasing. The excise tax on ethyl alcohol will be set at 15,000 UZS per liter, replacing the existing rates of 14,900 UZS for local products and 70% of the value for imports.

Related News

18:34 / 26.05.2025

Uzbekistan launches new tax inspectorate to enforce product labeling rules

16:55 / 15.05.2025

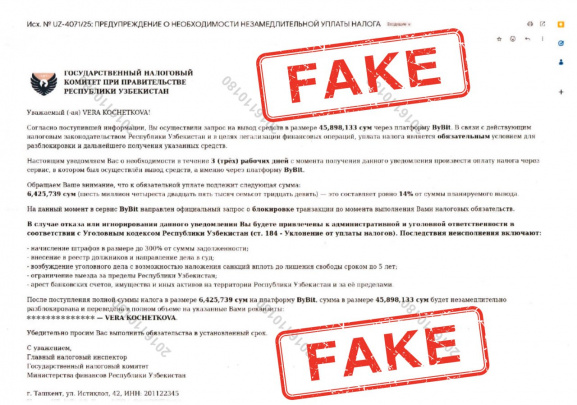

Tax Committee warns of fraudulent emails about tax debt

13:18 / 13.05.2025

Gov’t plans to tax bloggers earning from online ads

20:57 / 05.05.2025