All pharmaceutical and medical service companies to become VAT payers

Starting April 1, 2025, all legal entities engaged in the sale of pharmaceutical products or the provision of medical services will be subject to VAT, regardless of their income level.

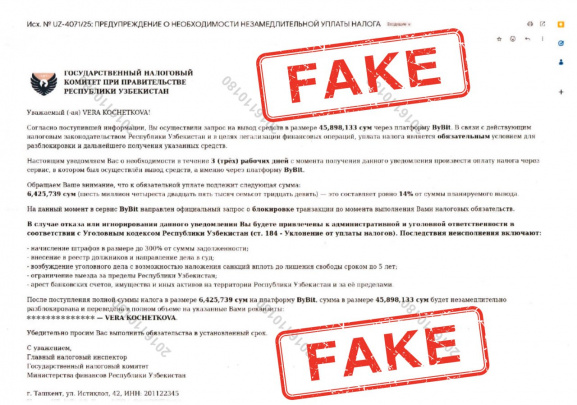

Photo: Telegram / soliqnews

The tax authorities will automatically generate VAT reports based on online cash registers (Online-NKT), electronic invoices (EHF), and other internal and external data sources.

This regulation will come into effect following amendments to the Tax Code.

Current taxation rules for the pharmaceutical and medical sectors

Under the existing legislation, the tax regime for legal entities engaged in pharmaceutical sales or medical services is as follows:

- Businesses with annual revenue up to 1 billion UZS pay a turnover tax.

- Businesses with annual revenue exceeding 1 billion UZS must switch to VAT and corporate profit tax.

The VAT rate is set at 12%, while the corporate profit tax rate is 15%. However, taxpaying entities engaged in social sector activities are exempt from the corporate profit tax (0%). The turnover tax rate is 4%.

Tax rates for pharmacies engaged in wholesale and retail drug sales

For pharmacies selling wholesale and retail medicines, tax rates are set as follows:

- Cities with a population of 100,000 or more – 3%

- Other settlements – 2%

- Remote and mountainous districts – 1%

Additionally, taxpayers have the right to pay a fixed turnover tax amount instead of the standard turnover tax.

Related News

12:21 / 27.05.2025

Hungarian pharma giants may launch medicine production in Uzbekistan

18:34 / 26.05.2025

Uzbekistan launches new tax inspectorate to enforce product labeling rules

15:24 / 26.05.2025

SSS uncovers 82 billion UZS in fraudulent VAT refunds

16:55 / 15.05.2025